This week’s focus is on Teqnion AB (TEQ.ST), a Swedish diversified industrial company, operates in the industry, growth, and niche business areas.

Business Overview:

Teqnion AB, founded in 2006, is a Swedish serial acquirer that focuses on niche industrial companies. Its subsidiaries span industries such as defence, data centre design, electrification, and construction, with a focus on acquiring "boring" yet profitable businesses to drive sustainable long-term growth. This diversification creates an "all-weather" portfolio, mitigating risks associated with individual markets or economic cycles. Teqnion’s subsidiaries operate in sectors with low susceptibility to disruption, providing a stable revenue base and long-term profitability.

Teqnion employs a dual growth engine strategy, combining organic growth with strategic acquisitions. Acquired companies are selected based on stringent criteria, including profitability, strong operating margins, competitive advantages, and market leadership in niche industries. The emphasis on sustainable product portfolios and low-risk operations ensures subsidiaries align with Teqnion’s philosophy of steady, long-term growth.

The company's business model also centres on a decentralised management approach, allowing subsidiaries to operate independently with an entrepreneurial ethos. Unlike traditional acquirers that impose centralised control, Teqnion provides its subsidiaries with autonomy to make quick and flexible decisions, fostering adaptability and a strong sense of ownership among their management teams. This autonomy is complemented by support from the parent company, which offers expertise, a broad contact network, and financial resources.

Its first non-Swedish acquisition in 2022, Belle Coachworks Limited, marked a step towards geographic diversification, with further opportunities anticipated across Europe. This expansion highlights Teqnion’s commitment to maintaining high acquisition standards while exploring new growth avenues.

Revenue Model:

Teqnion’s revenue model is built on a blend of organic growth and strategic acquisitions. By leveraging the cash flows generated by its subsidiaries, the company can fund new acquisitions without overextending financially, ensuring a sustainable growth cycle.

Acquisition Criteria:

Teqnion acquires smaller, profitable businesses that are often overlooked by larger players. The company targets businesses that meet stringent requirements, including:

Established operations in niche markets with defensible positions and minimal disruption risk.

Strong operating margins, with an EBITA margin target of at least 9%.

Attractive valuations, typically in the range of 4 to 5 times EBITA, ensuring high returns on invested capital (ROIC).

Proven profitability and a track record of consistent cash flow generation.

Leadership or near-leadership positions in their respective industries, ensuring competitive advantages.

Once acquired, subsidiaries operate independently, generating revenue through their specialised products and services. Subsidiaries are encouraged to allocate resources toward high-return projects, ensuring operational improvements and sustained profitability.

Moat Analysis

At the heart of Teqnion’s competitive advantage is the skill of its management team, especially in identifying, negotiating, and integrating acquisitions. This is arguably the most critical factor in the success of any serial acquirer. In Teqnion’s case, the management team demonstrates a disciplined approach and ensuring that these businesses remain profitable post-acquisition.

Furthermore, Teqnion believes that each of its subsidiaries has its own moat, whether through niche expertise, strong customer relationships, or operational efficiencies. Management’s skill in identifying these advantages during the acquisition process is critical.

However as mentioned, what truly sets Teqnion apart is its approach to managing acquired companies. Unlike many acquirers, Teqnion:

Preserves autonomy: Subsidiaries retain decision-making power, including how they allocate profits, ensuring a strong sense of ownership.

Avoids workforce cuts: Teqnion prioritises stability and continuity, fostering trust and loyalty within acquired companies.

Does not impose centralised leadership: Instead, it retains the original management teams, which preserves institutional knowledge and enhances subsidiary performance.

This decentralised model ensures that subsidiaries feel like independent businesses, not branches of a corporate entity. Such autonomy attracts high-quality acquisition candidates and encourages sustainable growth within each subsidiary.

Teqnion also deliberately targets "boring" businesses in niche markets. These companies often operate in sectors with low visibility and limited competition, making them unattractive to larger acquirers. This focus creates a natural barrier to entry, allowing Teqnion to secure acquisitions at attractive valuations. Additionally, Teqnion’s smaller size enables it to compete in a less crowded space, targeting smaller businesses that are overlooked by larger serial acquirers.

Overall, we belive that Teqnion’s moat is strong, built on its skilled management, disciplined acquisitions, and decentralised model. The focus on “boring” companies limits competition now, but this edge may diminish as Teqnion grows into larger markets. However, reliance on management does poses a risk, as the company’s success is heavily dependent on their continued execution.

Next, we will explore this management in greater detail.

Management

Key Figures:

Johan Steene – CEO and Founder

Johan Steene, Teqnion’s founder and CEO, has been at the helm since the company’s inception in 2006. Known for his hands-on leadership style, Steene is deeply involved in identifying acquisition targets and fostering relationships with potential candidates. Steene exemplifies a culture of cost-consciousness and long-term thinking. His commitment to efficient capital allocation is evident in his disciplined approach to acquisitions and operational oversight. Steene’s significant shareholding—equivalent to approximately 127 times his annual salary—aligns his interests closely with those of shareholders, reinforcing his focus on sustainable value creation.Daniel Zhang – CXO (Chief Acquisition Officer) and Deputy CEO

Daniel Zhang joined Teqnion in 2021, bringing experience from consultancy roles at firms like McKinsey and Bain & Company. As the Chief Acquisition Officer, Zhang is responsible for leading the company’s acquisition strategy, a role that is central to Teqnion’s success. His approach combines rigorous due diligence with a deep understanding of niche markets, ensuring that each acquisition adds strategic value to the portfolio. Zhang shares Steene’s long-term vision and admiration for disciplined investors like Warren Buffett and Charlie Munger. His focus on acquiring businesses with strong competitive advantages and sustainable profitability is reflected in Teqnion’s robust acquisition pipeline. Zhang’s substantial equity stake in the company—equivalent to 20 times his annual salary—further demonstrates his alignment with shareholder interests.

Alignment Through Incentives

Teqnion’s incentive structure is simple yet effective. Both Steene and Zhang, along with subsidiary management teams, are rewarded based on the company’s performance. Variable compensation is tied to profit growth compared to a rolling three-year average, ensuring that management remains focused on sustainable financial performance.

Skin in the Game

The leadership team’s significant shareholdings foster a culture of ownership and long-term accountability. In addition to Steene and Zhang, several senior managers and board members hold substantial equity stakes in Teqnion, further aligning their interests with those of investors. We also particularly appreciate that Teqnion discloses the ownership stakes of each member on their company page, demonstrating transparency and a commitment to shareholder alignment.

Commitment to Transparency and Long-Term Focus

Steene and Zhang actively participate in investor Q&A sessions, openly discussing challenges and lessons learned. Their candid communication style has earned the trust of both shareholders and acquisition candidates.

Chris Mayer – Board Member

In 2024, Teqnion welcomed Christopher Mayer to its board of directors. Mayer, a respected investor and author of 100 Baggers: Stocks That Return 100-to-1 and How to Find Them, brings valuable expertise to Teqnion’s leadership. His extensive research into companies that achieve exceptional long-term growth aligns seamlessly with Teqnion’s acquisition strategy.

Mayer’s investment philosophy and deep understanding of high-performing businesses are significant assets for the company. His decision to join the board, coupled with a notable equity stake in Teqnion, signals strong confidence in the company’s long-term prospects. Mayer’s presence further enhances the strategic guidance available to the management team, bolstering Teqnion’s ability to identify and nurture high-potential acquisitions.

The combination of strong leadership, disciplined execution, and aligned incentives ensures that Teqnion’s management team remains a key driver of its success. The addition of Chris Mayer, with his expertise in identifying long-term growth opportunities, further strengthens Teqnion’s position as a disciplined and forward-looking acquirer in niche markets.

Capital Allocation

Acquisitions are, of course, a central element of Teqnion’s capital allocation strategy, as previously outlined. However, there are additional aspects worth exploring beyond this.

Lack of Share Buybacks: Teqnion does not currently engage in share buybacks due to restrictions associated with its listing on the Nasdaq First North Growth Market. Even if permitted, management views buybacks as a secondary priority compared to reinvesting in high-return growth opportunities.

No Regular Dividends: Teqnion has historically refrained from paying dividends, with one exception in 2022. Once again, management believes that retaining earnings to reinvest in acquisitions and organic growth offers significantly higher returns than distributing cash to shareholders.

Arbitrage Through Share Issuance: Teqnion’s shares outstanding have slightly increased over recent years, however their ability to issue these shares at high price-to-earnings (P/E) multiples and reinvest the proceeds into acquisitions at lower multiples represents a key strength in its capital allocation strategy. By issuing shares at a P/E multiple of 30 and reinvesting the capital into acquisitions priced at 4 to 5 times earnings, the company captures a significant arbitrage opportunity. For instance, issuing $100 million in shares at a 30 P/E dilutes earnings by approximately $3.3 million. When reinvested into acquisitions priced at a 5 P/E, this capital acquires businesses generating $20 million in earnings. This spread between the cost of capital and the returns from reinvestment drives earnings per share (EPS) growth and enhances overall shareholder value.

Financials and Rough Valuation:

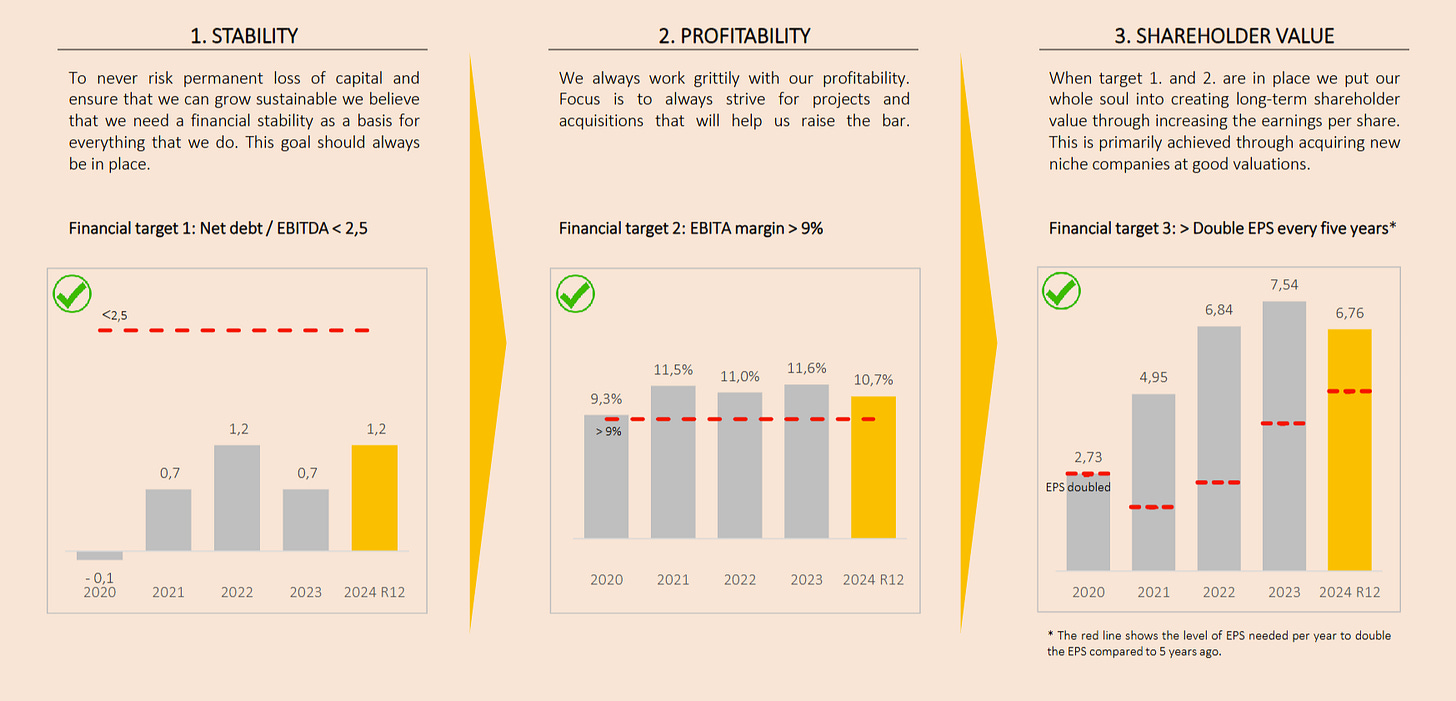

Teqnion employs a disciplined financial strategy anchored by three key targets: stability, profitability, and shareholder value. These targets are not only benchmarks of operational success but also form the foundation for its long-term growth and capital allocation decisions.

Stability: Teqnion prioritises financial stability to minimise the risk of permanent capital loss and enable sustainable growth. The company’s financial target is to maintain a net debt/EBITDA ratio below 2.5, ensuring a solid balance sheet and financial flexibility. As of the latest reporting period, Teqnion’s net debt/EBITDA ratio stands at 1.2, comfortably below the target threshold. This prudent leverage policy allows Teqnion to capitalise on acquisition opportunities without compromising its financial health.

Profitability: Profitability is a cornerstone of Teqnion’s operational model. The company targets an EBITA margin of at least 9% across its portfolio, ensuring strong operating efficiency and cash generation. Over the last four years, Teqnion has consistently exceeded this target, with a current EBITA margin of 10.7%.

Shareholder Value: Teqnion’s ultimate financial target is to double earnings per share (EPS) every five years, which requires a consistent annual growth rate of approximately 15%. Teqnion is comfortably on track for this since the last double.

With this in mind, below are our back-of-the-napkin intrinsic value estimates based on a 10% discount rate and a 10-year timeframe .

Bull: 20% EPS Growth Rate, 25 PE - SEK 400 Per Share

Base: 15% EPS Growth Rate, 20 PE - SEK 210 Per Share

Bear: 10% EPS Growth Rate, 16 PE - SEK 110 Per Share

The Thesis:

We believe Teqnion’s recent stock price decline presents an attractive opportunity for long-term investors. The pullback has largely been driven by losses in the company’s housing-related segment, stemming from challenges in the Swedish housing market. These challenges, primarily caused by rapidly rising interest rates and reduced demand for new homes, have weighed on performance in this portion of Teqnion’s portfolio.

However, we view these headwinds as transitory and believe they have created a mispricing in the stock. Teqnion’s disciplined acquisition strategy, decentralised management model, and strong financial targets—such as its goal to double EPS every five years—provide a robust foundation for sustainable growth.

Moreover, this setback could ultimately become an opportunity. Rising interest rates and economic pressures may lead to consolidation in the housing sector, with smaller, less-capitalised players exiting the market. Teqnion’s financial stability and disciplined management ensure its subsidiaries in this space are well-positioned to weather the current challenges and potentially gain market share as conditions improve.

The addition of Chris Mayer to the board is another underappreciated development. This isn’t a case of blindly following a well-known investor into a position; rather, it highlights that an investor whose philosophy revolves around identifying long-term compounders has taken a significant stake in Teqnion. Mayer’s presence brings valuable insight to the board and further validates the company’s long-term potential.

For investors confident in Teqnion’s management and strategy, the current price offers an excellent opportunity to invest in a high-quality, well-managed business poised for continued success. We estimate Teqnion’s fair value to be around SEK 210, making the current valuation an attractive entry point, even if the stock faces further short-term volatility.

For full transparency, we will be initiating a position in Teqnion in the coming weeks. See the rest of our portfolio here:

Risks:

While Teqnion has demonstrated strong financial performance and built a solid competitive moat, investors should remain mindful of certain risks that could impact its long-term growth and valuation.

1. Acquisition Risk

Teqnion’s growth heavily relies on finding and acquiring suitable businesses at attractive valuations. As the company grows, it may face increased competition from larger acquirers, potentially driving up acquisition costs or limiting the availability of high-quality targets.

Integrating acquired companies always carries the risk of cultural mismatches or operational inefficiencies, which could impact group profitability.

2. Management Dependence

A significant portion of Teqnion’s success is attributed to its skilled management, particularly CEO Johan Steene. A change in leadership or missteps in strategic execution could materially affect the company’s performance and competitive advantage.

3. Economic and Sectoral Cycles

While Teqnion’s portfolio is diversified, it remains exposed to economic downturns or sector-specific challenges, particularly in industries such as construction and manufacturing, which are cyclical in nature.

A prolonged economic slowdown could reduce customer demand, impacting subsidiary performance and acquisition opportunities.

4. Increasing Competition

As Teqnion grows, it may move into markets with larger and more established competitors. This could erode its niche focus and make it harder to maintain current acquisition multiples.

The company’s reliance on acquiring "boring" businesses may attract imitators, increasing competition even in smaller niches.

5. Execution Risk in Scaling

Managing a growing number of subsidiaries may strain Teqnion’s decentralised model, potentially leading to oversight challenges or inefficiencies.

The company’s ability to maintain its unique operational philosophy at scale is crucial for sustaining its competitive advantage.

6. Share Dilution

Teqnion’s use of share issuances to fund acquisitions poses a risk of dilution for existing shareholders. While the arbitrage between high P/E issuance and low multiple acquisitions has been beneficial, overreliance on this strategy could affect shareholder returns.

7. Dependence on Subsidiary Performance

Teqnion’s decentralised model depends on the success and independence of its subsidiaries. Poor performance by key subsidiaries could significantly impact overall profitability.

Ensuring alignment between subsidiary management and group goals remains a critical challenge as the portfolio expands.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. While we believe the information to be reliable, we cannot guarantee its accuracy. The opinions expressed are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

Great dive into Teqnion! We have a free report and podcast into Teqnion as well if you're interested.

https://www.thedutchinvestors.com/post/teqnion

It has been a tough year for the company but the ship is slowly turning. They are still small and nimble to where they can improve and implement new processes without tons of bureaucracy. Hoping for green shoots in 2025!