We’ve just reached 1000 subscribers! A big thank you to everyone supporting us—this is just the start!

Performance

We want to remind you each update, although we are updating you on our performance every two weeks, we do not get excited or upset about short-term fluctuations. Our focus remains on long-term value creation. Please remember this especially when looking at your own portfolio and making investment decisions.

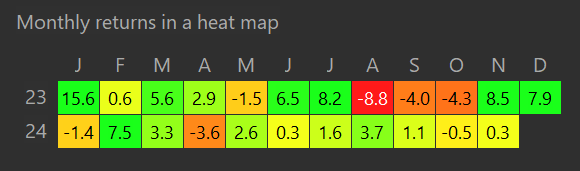

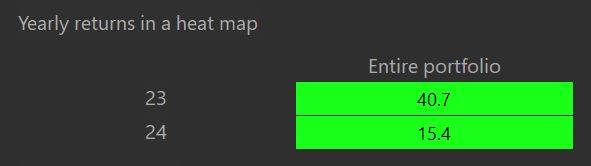

Over the past 2 weeks, our portfolio has seen a slight decrease. November’s performance has now fallen from 2.1% to a 0.3% gain. This brings our year-to-date return down to 15.4%.

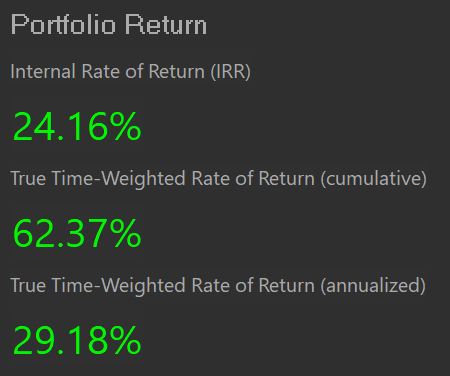

Overall our annualised TWR now sits at 29.18%.

The primary drivers of this period’s performance were Meta Platforms META 0.00%↑, falling from 491.18% to 466.72% and Alphabet GOOGL 0.00%↑, dropping from 95.29% to 82.74%. Evolution AB ($EVVTY) also contributed negatively, sliding further from -9.04% to -11.00%. Nu Holdings NU 0.00%↑ also saw a heavy decline, falling from 103.78 to 80.42 in the period.

Nintendo ($NTDOY) remained mostly flat, increasing marginally from 6.85% to 6.21%. BAE Systems ($BA.L) experienced a slight decline, moving from 8.78% to 3.45%.

On the positive side, PayPal Holdings PYPL 0.00%↑, the largest holding, contributed meaningfully to performance, rising from 29.82% to 33.76%. Finally, RCI Hospitality Holdings RICK 0.00%↑ staged a recovery, improving from 2.92% to to 5.73%.

The News

As always, we are hesitant to provide macro commentary as it would likely just be noise, and frankly, we're tired of hearing about it ourselves. Instead, we'll focus on company-specific news that may impact our holdings.

Google faces potential breakup in DOJ antitrust proposal: The U.S. Department of Justice (DOJ) has proposed a partial breakup of Google to address its monopoly in online search. The DOJ is urging a federal judge to force Google to sell its Chrome web browser and potentially its Android operating system.

Key points of the DOJ's proposal:

Sell Chrome browser to open up competition in web browsing

Restrict Android from promoting Google's search engine

Ban exclusive agreements, such as making Google the default search on Apple devices

Require data sharing with rival search engines for 10 years

Prohibit Google from investing in or acquiring search rivals or AI companies.

Google's response: The company has criticised the proposal as "extreme" and "harmful," arguing it would negatively impact millions of users, threaten privacy and security, slow innovation in AI, and undermine America's position as a global tech leader.

Potential impact: If approved, these measures could significantly alter the competitive landscape of the internet, affecting how millions of Americans access information and potentially disrupting the interconnection among Google's products and services.

Next steps: Google is expected to submit its own counter-proposals by December 20. Both parties may revise their requests before Judge Mehta hears arguments in the spring, with a ruling anticipated by the end of summer 2025.

Trades

There have been no changes to the portfolio over the past two weeks.

That said, we want to take a moment to highlight an important point: unlike many publications, we strive to provide a realistic, no-hype representation of what investing truly entails. We’re not constantly buying or selling stocks just to create the illusion of activity. Instead, we stay true to our philosophy—taking action only when it aligns with our strategies and when genuine opportunities arise.

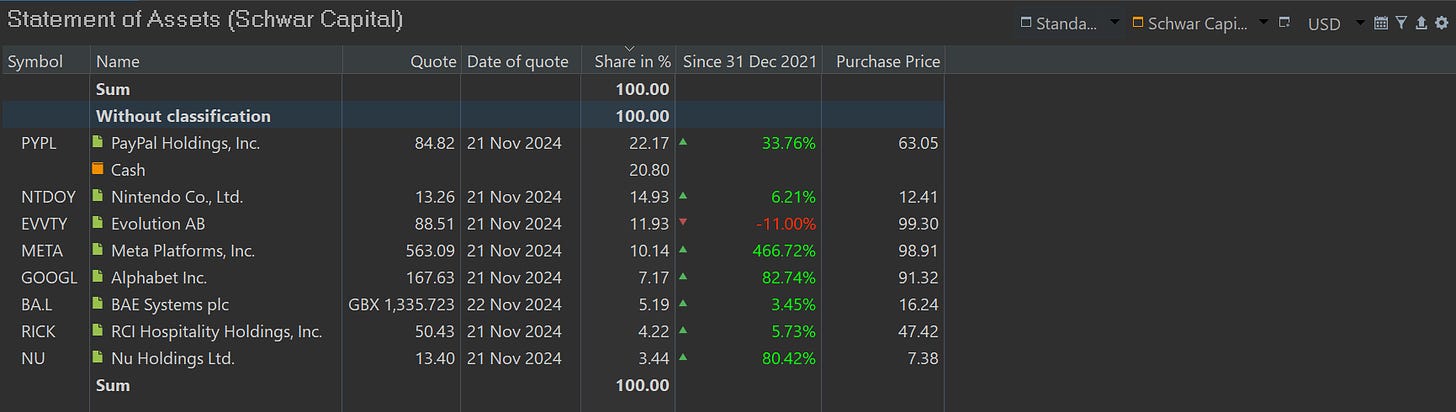

Statement of Assets

Breakdown:

PayPal Holdings, Inc. (PYPL)

Share of Portfolio: 22.17%

Purchase Price: $63.05

Total Return: 33.76%

Investment Thesis:

Cash

Share of Portfolio: 20.80%

Nintendo Co., Ltd. (NTDOY)

Share of Portfolio: 14.93%

Purchase Price: $12.41

Total Return: 6.21%

Investment Thesis:

Evolution AB (EVVTY)

Share of Portfolio: 11.93%

Purchase Price: $102.31

Total Return: -11.00%

Investment Thesis:

Meta Platforms, Inc. (META)

Share of Portfolio: 10.14%

Purchase Price: $98.91

Total Return: 466.72%

Investment Thesis: Coming soon…

Alphabet Inc. (GOOGL)

Share of Portfolio: 7.17%

Purchase Price: $91.32

Total Return: 82.74%

Investment Thesis: Coming soon…

BAE Systems plc (BA.L)

Share of Portfolio: 5.19%

Purchase Price: £12.70

Total Return: 3.45%

Investment Thesis:

RCI Hospitality Holdings, Inc. (RICK)

Share of Portfolio: 4.22%

Purchase Price: $47.42

Total Return: 5.73%

Investment Thesis: Coming soon…

Nu Holdings Ltd. (NU)

Share of Portfolio: 3.44%

Purchase Price: $7.38

Total Return: 80.42%

Investment Thesis:

We hope you found this valuable. Have a great weekend.

The S.C. Team

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] PayPal (PYPL) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2ec95c38-51d6-4f98-a32f-f4bcfd42102c_2560x1920.jpeg)

![[FREE] Nintendo (NTDOY) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F85de3997-55a8-41ff-b579-f5aaa8bd1af6_400x400.jpeg)

![[FREE] Evolution AB (EVO.ST) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4563cd74-03c3-4c89-b5ee-f7047e980201_700x700.png)

![[FREE] BAE Systems (BA.L) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fefb4943a-9762-4828-9651-671db8384d00_6690x6352.png)

![[FREE] Nu Holdings (NU) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbf450a78-515a-4766-a7b9-f43ca6a09672_2135x2120.png)