Welcome to this week's edition of Reflections. In this issue, we dive into the Kelly Criterion and its application in investing. Originally developed for telecommunications and gambling strategies in 1956 by John L. Kelly Jr., the Kelly Criterion has since found its place in the world of finance as an interesting method for determining capital allocation.

Preface

Before we dive in, we want to be upfront about the limitations of the Kelly Criterion in its application to finance. The formula has its flaws, and we generally advise against relying too heavily on precise numbers generated by formulas in our investment approach. We prefer to be roughly right than precisely wrong. However, we still believe this concept is worth your time and consideration.

In our opinion, what makes the Kelly Criterion valuable isn’t its ability to provide an exact percentage for position sizing, but rather its principles: it emphasises allocating a larger portion of your portfolio to your best opportunities, and it teaches you to think in terms of asymmetry—balancing potential upside against downside risk. This is why we believe the formula is useful—not as a precise tool, but as an exercise and rough guide for thoughtful position sizing in your portfolio.

Understanding the Kelly Criterion

The Kelly Criterion is a mathematical formula designed to help investors decide how much capital to allocate to an investment based on its probability of success and potential reward. Created by John L. Kelly Jr. in 1956 while at Bell Labs, the formula was initially used for telecommunications and betting strategies. However, its relevance in finance soon became apparent.

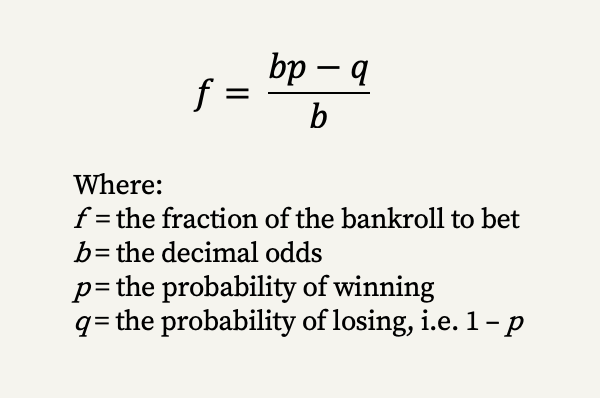

The Kelly formula is:

By focusing on both probabilities and potential returns, the Kelly Criterion offers a structured way to manage risk. It’s not about chasing the highest returns but about finding the right balance between risk and reward to maximise long-term growth and minimise the chances of substantial losses.

From Casinos to Wall Street

The Kelly Criterion became widely known when famed gambler and hedge fund manager Edward O. Thorp applied it to both blackjack and investing. In his seminal book Beat the Dealer, Thorp used Kelly's formula to develop a winning strategy in blackjack. He later applied the same principles in the stock market with great success.

Thorp’s experience highlighted something important: the Kelly Criterion doesn’t just apply to scenarios with obvious odds, like gambling. In investing, where uncertainty is inherent, the framework provides a disciplined approach to betting on investment opportunities where the odds are in your favour.

The Kelly Criterion encourages investors to think carefully about two key elements:

What is the likelihood of success?

What is the magnitude of potential returns?

But unlike a game of blackjack, where probabilities are well-defined, the challenge in investing lies in estimating these figures with reasonable accuracy. That’s where the difficulty—and the art—of applying Kelly to investing begins.

The Kelly Criterion and Asymmetry in Investing

At its heart, the Kelly Criterion embodies the concept of asymmetry. In investing, asymmetry refers to situations where the potential upside significantly outweighs the downside. The Kelly formula helps investors take advantage of asymmetrical opportunities by systematically determining how much capital to allocate when the odds and potential rewards are favourable, without overexposing yourself to risk.

This focus on asymmetry aligns with one of our core principles at Schwar Capital. We believe in identifying and capitalising on asymmetrical opportunities in the market is key to long term success. For more on our investing philosophy, check out the article below:

The Application to Stock Picking

Let's consider a hypothetical stock investment opportunity.

There's a 60% chance the stock will appreciate by 25%

There's a 40% chance the stock will depreciate by 15%

The variables for the Kelly formula will look as follows:

b = 25/15 = 1.67 (the ratio of potential gain to potential loss)

p = 0.60 (probability of gain)

q = 1 – 0.60 = 0.40 (probability of loss)

Based on the Kelly criterion:

K% = (b * p - q) / b

K% = (1.67 * 0.60 - 0.40) / 1.67 = 0.24 or 24%

The formula is, therefore, suggesting that 24% of your portfolio be allocated to this stock. If the odds were less favourable, say a 53% chance of appreciation and 47% chance of depreciation with the same potential gains and losses, the Kelly criterion would recommend staking only about 6% of your portfolio.

In such a case, the Kelly criterion suggests that if one were to consistently invest over 24% in similar opportunities, there's a high chance of eventually depleting your capital due to the inherent risks. This is because overexposure amplifies the impact of losses, which can compound over time and erode your portfolio. Under-investing less than 24%, on the other hand, would lead to smaller profits over time, as you're not fully capitalising on the favourable odds. This illustrates the delicate balance the Kelly Criterion aims to achieve – maximising long-term growth while managing risk. By adhering to this 24% allocation, you're optimising your position size to capture the most benefit from the asymmetrical opportunity without exposing yourself to excessive risk.

Fractional Kelly

While the Kelly Criterion provides a mathematically optimal allocation for long-term growth, in practice, many investors find the suggested allocation too aggressive. After all, putting a large portion of your portfolio into a single stock, as the full Kelly often suggests, carries significant risks due to market volatility and the potential for miscalculating probabilities. This is where the concept of fractional Kelly comes into play. A fractional Kelly strategy involves using only a portion of the full Kelly allocation, typically half (Half-Kelly) or a quarter (Quarter-Kelly). This approach aims to reduce portfolio volatility while still benefiting from the Kelly framework's growth optimisation principles.

Ultimately, the choice between full Kelly, Half-Kelly, Quarter-Kelly, or even smaller denominations depends on your individual risk tolerance, investment goals, and the level of confidence in your probability estimates. The key is to use these insights consistently within your overall investment strategy, always remembering that the Kelly Criterion is a guideline rather than an absolute rule.

Behavioural Considerations:

Investing is not just a numbers game; human psychology plays a significant role. Even the most mathematically sound strategies can fall prey to emotional biases. The Kelly Criterion can be particularly dangerous in the hands of overconfident investors who might overestimate probabilities or potential returns.

Behavioural finance has shown us time and again that investors are prone to making errors in judgment. For example, we tend to overvalue information that confirms our biases and often react irrationally to market fluctuations. The Kelly Criterion, in its strict form, can exacerbate these tendencies if used carelessly.

This is another reason why fractional Kelly is often recommended. It tempers the aggressiveness of the formula, allowing for a more measured approach to portfolio management.

Further Limitations of the Kelly Criterion

While the Kelly Criterion offers a sound mathematical approach to position sizing, it carries several important limitations when applied to investing:

Assumes Infinite Opportunities: The formula presumes that investors will encounter repeated, identical opportunities over time. In reality, investment opportunities are unique and limited, making strict application of the Kelly logic challenging.

Difficulties in Estimating Probabilities: Accurately estimating probabilities of success and potential outcomes is often based on incomplete or imperfect information. This can lead to overconfidence in the calculated position size and misallocation of capital.

Correlation Between Investments: The Kelly Criterion assumes that each investment is independent. However, investments often move together due to sector, industry, or macroeconomic factors, increasing vulnerability to sector-wide downturns or economic shifts.

Time Horizon Mismatch: The Kelly Criterion is designed for long-term capital growth, which may not align with the goals or risk tolerances of all investors, particularly those with shorter investment horizons.

Psychological Challenges: Following Kelly-sized allocations can be psychologically taxing, especially during periods of volatility or drawdowns. This can result in emotional decision-making that strays from the optimal strategy.

Estimation Error Sensitivity: The Kelly Criterion is highly sensitive to the accuracy of probability estimates. Overestimating your edge or the likelihood of success can lead to excessive risk-taking and significant capital losses.

Non-Normal Distributions: Financial returns often exhibit fat tails and skewness, which may not be fully captured by the basic Kelly formula. This can lead to an underestimation of the risk of extreme events.

Assumes Constant Bankroll: The formula assumes a constant bankroll, but in practice, investors may add or withdraw funds, which can alter the capital base for calculations.

Conclusion

The Kelly Criterion provides a valuable framework for thinking about position sizing and capital allocation. It encourages investors to focus on asymmetry and allocating more capital to the highest-conviction opportunities. However, while mathematically appealing, it’s important to acknowledge its limitations. The assumption of independent bets, infinite opportunities, and accurate probability estimates can lead to missteps if applied rigidly in the complex, interconnected world of investing.

As a result, blindly following the Kelly Criterion without adapting to real-world variables—like market correlation or sector exposure—could lead to unintended concentration risks or missed opportunities.

Instead of treating it as a precise guide, the Kelly Criterion should be viewed as a thought exercise—a tool to help investors think strategically about where their best opportunities lie and how to size positions relative to the risks and rewards they perceive. As we mentioned in the preface, we would rather be "roughly right than precisely wrong," and this mindset applies here: use Kelly as a rough guide, not a rigid rule. Overall, the Kelly Criterion can still provide valuable insights for long-term investing strategies.

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![Our Investing Philosophy [Free Checklist]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F43eb5ad6-6a32-45eb-989a-5f929c2b740d_1080x1080.png)

How many times do we need to throw the dice until the probability and the criterion becomes meaningful?

I think you addressed this point when you said that the criterion is only relevant over the long term, that is when the dice is thrown many times.