Welcome to this week's edition of Reflections. In this issue, we dive into The Case for a Concentrated Portfolio. In the world of investing, there's a common belief that diversification is the ultimate safeguard against risk. While this approach has its merits, we believe that there can sometimes be a more effective way to manage risk and maximise returns: concentration.

“The idea of diversification makes sense to a point - if you don't know what you're doing. If you want the standard result and don't want to end up embarrassed - then of course, you should widely diversify. But nobody is entitled to a lot of money for holding this view. It's like knowing 2 plus 2 is 4. Any idiot can diversify a portfolio.”

—Charlie Munger

Understanding the Limits of Diversification

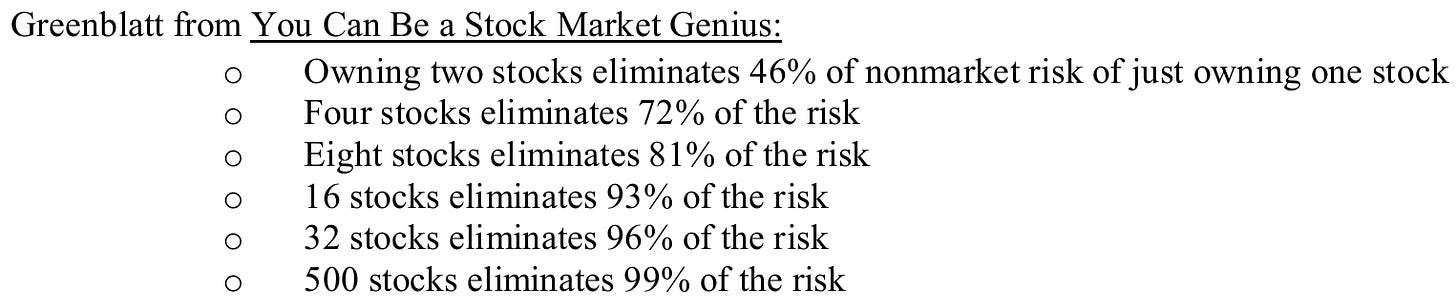

Diversification, when taken to its extreme, can become a double-edged sword. The primary purpose of diversification is to reduce unsystematic risk—the risk specific to individual companies—by spreading investments across various stocks, sectors, and geographies. However, as the number of holdings in a portfolio increases, the benefits of diversification diminish. After a certain point, adding more stocks does little to further reduce risk and instead begins to water down the potential for outperformance. Here is an extract from Greenblatt’s work, You Can Be a Stock Market Genius, that supports this.

In fact, holding too many stocks can result in a portfolio that closely tracks the performance of a broad market index. This is the essence of over-diversification. When a portfolio becomes too diversified, it essentially mirrors the market itself, diminishing the investor's ability to generate alpha—returns that exceed the market average.

The Impact of Diversification on Volatility

One of the key benefits of diversification is its ability to reduce portfolio volatility. By spreading investments across different assets, diversification helps to smooth out the ups and downs associated with market fluctuations. This can be especially comforting during periods of high volatility, as it reduces the likelihood of sharp declines in portfolio value.

However, it's important to recognise that for individual investors, volatility is often less of a concern than it is for institutional investors or fund managers. Unlike professionals who must report quarterly results, individual investors have the luxury of taking a long-term view. As renowned investors like Seth Klarman have pointed out that "using beta and volatility to measure risk is nonsense," echoing the sentiment that risk should be understood as the permanent loss of capital, not the temporary fluctuations in asset prices (read our philosophy on more to do with asymmetric bets). Volatility is a normal part of the market's behaviour and should not be feared, provided you have the ability to stay the course.

Embracing a Long-Term Approach to Mitigate Risks

Patience is essential in a concentrated portfolio. By holding a smaller number of stocks, one is naturally more exposed to the fluctuations of individual companies. However, by maintaining a long-term focus, one can capture the full value of their investments as they grow and evolve over time. This discipline helps avoid the pitfalls of short-term thinking and reactive decision-making, which can undermine long-term returns.

“Worrying about near-term volatility has nothing to do with being a successful value investor."

—Joel Greenblatt

Concentration: A Strategy for Outperformance

Our approach to portfolio management is rooted in the belief that concentration, when executed with discipline and insight, can offer a more compelling risk-reward balance. By limiting our holdings to between 8 and 12 stocks, we focus our capital on our highest-conviction ideas—those investments that we believe have the greatest potential to deliver substantial long-term returns.

This strategy is not about taking on unnecessary risk, but rather about making each investment count. In a concentrated portfolio, every position must earn its place. We conduct rigorous analysis and due diligence on each company, considering factors such as business quality, competitive advantage, management strength, and valuation. Only those companies that meet our stringent criteria make it into the portfolio, ensuring that every dollar invested is backed by deep research and strong conviction.

"If you can identify six wonderful businesses, that is all the diversification you need. And you will make a lot of money. And I can guarantee that going into a seventh one instead of putting more money into your first one is gotta be a terrible mistake. Very few people have gotten rich on their seventh best idea. But a lot of people have gotten rich with their best idea. So I would say for anyone working with normal capital who really knows the businesses they have gone into, six is plenty, and I probably have half of what I like best. I don‘t diversify personally."

—Warren Buffett

The Benefits of a Concentrated Portfolio

Maintaining a concentrated portfolio offers several key benefits, each contributing to our overarching goal of delivering superior returns while effectively managing risk.

Deep Understanding of Investments: One of the most significant advantages of holding fewer stocks is the ability to develop a deep understanding of each company in the portfolio. With a concentrated portfolio, we can dedicate more time and resources to researching and monitoring each investment. This deeper level of insight allows us to better comprehend the risks and opportunities associated with each company, enabling more informed decision-making.

Conviction and Focus: A concentrated portfolio allows us to remain committed to our investments, even during turbulent market conditions, rather than being swayed by short-term fluctuations which might occur in a more diversified, less focused approach.

Minimised Turnover and Cost Efficiency: One of the key advantages of managing a concentrated portfolio is the ability to minimise portfolio turnover. By focusing on a smaller number of high-conviction investments, we reduce the need for frequent buying and selling, which can drive up transaction costs and trigger taxable events. Lower turnover not only helps keep commissions and taxes to a minimum, enhancing net returns, but also allows us to maintain our positions long enough to fully realise the value of our investment theses.

Enhanced Potential for Outperformance: By concentrating our investments in a smaller number of high-conviction ideas, we increase the potential for outsized returns. If our analysis and judgment are correct, these concentrated positions have the potential to deliver significant gains, driving the overall performance of the portfolio. While this approach requires a high degree of confidence and discipline, we believe it offers the best chance to achieve superior long-term results.

The Importance of Selective Concentration

While a concentrated portfolio does involve some degree of company-specific risk, we believe that this risk is mitigated by our rigorous investment process. Each stock in our portfolio undergoes thorough scrutiny before being added, with a focus on understanding the key drivers of its long-term success. This process includes an in-depth analysis of the company’s financial health, competitive position, growth prospects, and the quality of its management team.

It’s also important to note that concentration does not mean putting all of our eggs in one basket. Even within a concentrated portfolio, we seek to diversify across different sectors and industries to some extent, ensuring that we are not overly exposed to any single economic trend or market factor. This selective diversification helps balance the portfolio while still allowing us to maintain our focus on our best ideas. We also operate somewhat of a barbell approach by always having a meaningful cash position to take advantage of market corrections.

We like to think of a concentrated portfolio as if you lived in a small town and had $1 million to invest. If you have carefully researched to find the best 5 companies, the risk is minimal.

“The way to minimise risk is to think."

—Charlie Munger

Conclusion

Our philosophy of concentration is grounded in the belief that a focused portfolio of high-conviction investments provides the best path to long-term success. By carefully selecting and holding between 8 to 12 stocks, we achieve a balance that mitigates company-specific risk while avoiding the dilution of returns often seen with over-diversification. This approach demands discipline, patience, and an in-depth understanding of each investment.

However, it’s important to note that this strategy may not be suitable for every investor, depending on their personal preferences and stage in their investing journey. As Gerald Loeb wisely stated, "Once you attain competency, diversification is undesirable." For those with the conviction and competence to execute it well, concentration can be a powerful tool, but for those without, it can be very dangerous. At the end of the day, the correct strategy is what works best for you.

For more insight into our investing philosophy and the checklist we use to analyse companies, you can explore further here:

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![Our Investing Philosophy [Free Checklist]](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F43eb5ad6-6a32-45eb-989a-5f929c2b740d_1080x1080.png)

Great stuff! Glad to find another concentrated investor on substack! I would add that this style of investing also increases awareness that investing is ownership. When you only hold 5 stocks like me, I really own those businesses. Impossible to really know what’s going on with the 35th company in a portfolio.

In the same boat. You need the ability to say no often and be prepared for more volatility. As you rightly mention, it is very personal