We’ve just reached 825 subscribers! A big thank you to everyone supporting our mission to provide high-quality, noise-free investment insights.

Performance

We want to remind you each update, although we are updating you on our performance every two weeks, we do not get excited or upset about short-term fluctuations. Our focus remains on long-term value creation. Please remember this especially when looking at your own portfolio and making investment decisions.

Over the past three weeks, our portfolio has seen a moderate increase. The overall return in October finished at -0.5%, however November has started off strong with a 2.1% gain. This brings our year-to-date return up to 17.4%.

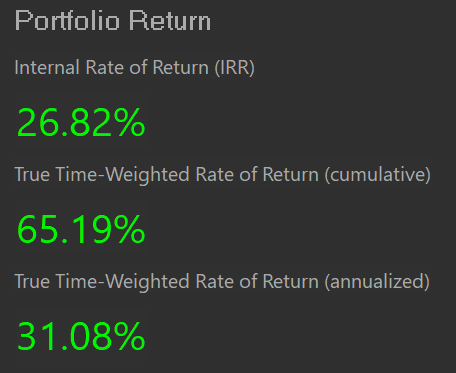

Overall our annualised TWR now sits at 31.08%.

The primary drivers of this period’s performance were PayPal Holdings PYPL 0.00%↑ , the largest holding, which increased from 25.88% to 29.82%, and Nu Holdings NU 0.00%↑, which made a substantial gain from 90.65% to 103.78%. Meta Platforms META 0.00%↑ also contributed, moving from 480.65% to 491.18%.

Additionally, Nintendo ($NTDOY) saw an increase from 7.33% to 8.78%, while BAE Systems ($BA.L) rose slightly from 5.76% to 8.78%. RCI Hospitality Holdings RICK 0.00%↑ showed improvement, going from -6.74% to 2.92%, and Alphabet GOOGL 0.00%↑ continued its growth, moving up from 77.61% to 95.29%.

The News

As always, we are hesitant to provide macro commentary as it would likely just be noise, and frankly, we're tired of hearing about it ourselves. Instead, we'll focus on company-specific news that may impact our holdings.

Since our last portfolio update, there have been many updates to the portfolio, with a large proportion of the portfolio announcing earnings.

PayPal Earnings: PayPal's Q3 2024 results showed revenue growth of 6% year-over-year to $7.8 billion, with total payment volume up 9% to $422.6 billion. Despite beating analyst expectations with adjusted EPS of $1.20, up 22% year-over-year, the stock slipped following the earnings release. We are happy with PayPal's results, recognising that they are in a transition year. We appreciate the company's focus on profitable growth going forward and their commitment to investing for the long run. This strategy may impact short-term growth but positions PayPal well for sustainable future success.

Nintendo Earnings: Nintendo's Q2 FY2025 results revealed significant challenges, with revenue falling 46.5% year-over-year. The company reduced its Switch sales forecast for the fiscal year from 13.5 million to 12.5 million units. Despite these headwinds, our investment thesis has been confirmed. Nintendo has recently mentioned on Twitter that they are focusing on creating a backwards-compatible platform for their next console. This strategic move could potentially smooth the transition to the new hardware and maintain the valuable existing user base, which aligns with our long-term outlook for the company. Investors seemed to like this development with the stock opening 2.5% higher on the OTC market following the earnings release.

Meta Earnings: Meta reported strong Q3 2024 results, with revenue growing 19% year-over-year to $41 billion. The company's advertising business showed resilience, with both ad impressions and average price per ad increasing by 7% and 11% respectively. Meta's shares traded slightly down after hours, despite the positive results. The company's continued heavy investment in AI and the metaverse, while promising for long-term growth, may be putting some short-term pressure on margins.

Evolution AB Earnings: Evolution AB's Q3 2024 showed solid growth, with total operating revenue increasing by 15% year-over-year to €579 million. The Live Casino segment grew by 15.8% to €447 million, while RNG revenues increased by 8.5% to €72.5 million. Management's decisions and Evolution's ability to address operational challenges without sacrificing growth reflect solid fundamentals. Given the company's performance amid adversity, we are confident in Evolution's long-term potential and its capability to manage short-term challenges.

Google Earnings: Alphabet, Google's parent company, reported strong Q3 2024 results, with revenue growing 11% year-over-year to $76.7 billion. The company's core advertising business showed resilience, with Google Search and other revenues increasing by 11%. YouTube ads revenue also saw a significant boost, growing by 12%. Google Cloud continued its impressive performance, with revenue up 22% year-over-year. We view these results positively, as they demonstrate Google's ability to maintain growth across its diverse business segments while continuing to invest in future technologies like AI and cloud computing.

Trades

As mentioned in our last update, we were considering an increase in our position in Evolution AB but wanted to first evaluate their recent earnings to assess management’s handling of current challenges. Earnings were initially met with a positive market reaction, and we were encouraged by management's proactive approach. However, as shares have since fallen close to pre-earnings levels, we see this as an attractive opportunity to add to our position at approximately a 7% free cash flow yield. Over the past week, we've been purchasing shares at an average price of $91.98, making Evolution AB our third-largest holding, now representing 11.99% of the portfolio.

Aside from this addition, the only other portfolio change was an increase in cash inflows.

Statement of Assets

Breakdown:

PayPal Holdings, Inc. (PYPL)

Share of Portfolio: 21.15%

Purchase Price: $63.05

Total Return: 29.82%

Investment Thesis:

Cash

Share of Portfolio: 20.94%

Nintendo Co., Ltd. (NTDOY)

Share of Portfolio: 14.76%

Purchase Price: $12.41

Total Return: 6.85%

Investment Thesis:

Evolution AB (EVVTY)

Share of Portfolio: 11.99%

Purchase Price: $102.31

Total Return: -9.04%

Investment Thesis:

Meta Platforms, Inc. (META)

Share of Portfolio: 10.4%

Purchase Price: $98.91

Total Return: 491.18%

Investment Thesis: Coming soon…

Alphabet Inc. (GOOGL)

Share of Portfolio: 7.53%

Purchase Price: $91.32

Total Return: 95.29%

Investment Thesis: Coming soon…

BAE Systems plc (BA.L)

Share of Portfolio: 5.36%

Purchase Price: £12.70

Total Return: 8.78%

Investment Thesis:

RCI Hospitality Holdings, Inc. (RICK)

Share of Portfolio: 4.04%

Purchase Price: $47.42

Total Return: 2.92%

Investment Thesis: Coming soon…

Nu Holdings Ltd. (NU)

Share of Portfolio: 3.82%

Purchase Price: $7.38

Total Return: 103.78%

Investment Thesis:

We hope you found this valuable. Thank you for your ongoing support—more updates are on the way.

The S.C. Team

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] PayPal (PYPL) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2ec95c38-51d6-4f98-a32f-f4bcfd42102c_2560x1920.jpeg)

![[FREE] Nintendo (NTDOY) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F85de3997-55a8-41ff-b579-f5aaa8bd1af6_400x400.jpeg)

![[FREE] Evolution AB (EVO.ST) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4563cd74-03c3-4c89-b5ee-f7047e980201_700x700.png)

![[FREE] BAE Systems (BA.L) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fefb4943a-9762-4828-9651-671db8384d00_6690x6352.png)

![[FREE] Nu Holdings (NU) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbf450a78-515a-4766-a7b9-f43ca6a09672_2135x2120.png)

Great portfolio! Also, I absolutely love this layout. Mind if I take some inspiration for my next portfolio update?