We’ve just reached 600 subscribers! A big thank you to everyone supporting our mission to provide high-quality, noise-free investment insights.

We've just launched an X account to bring you even more content! If you haven’t already, give us a follow by clicking the button below!

Performance

We want to remind you each update, although we are updating you on our performance every two weeks, we do not get excited or upset about short-term fluctuations. Our focus remains on long-term value creation. Please remember this especially when looking at your own portfolio and making investment decisions.

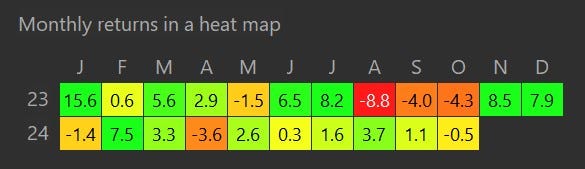

Over the past two weeks, our portfolio has seen a small increase. The overall return in October is now -0.5%, up from the previous update of -1.3%. This brings our year-to-date return up to 14.9%.

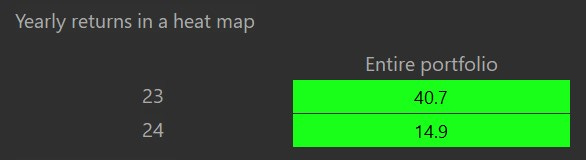

Overall our annualised TWR now sits at 30.66%.

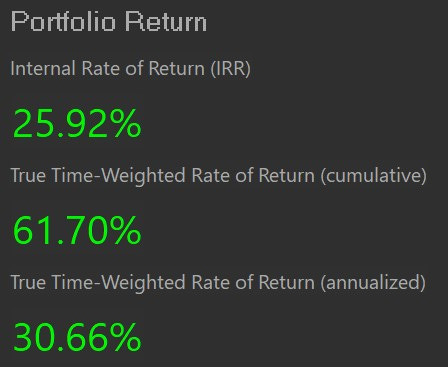

The primary drivers of this period’s performance were PayPal Holdings PYPL 0.00%↑ , which increased from 21.92% to 25.88%, and Nu Holdings NU 0.00%↑ , rising from 76.38% to 90.65%. RCI Hospitality Holdings RICK 0.00%↑ also reduced its losses, improving from -12.72% to -6.74%. Additionally, Nintendo (NTDOY) and BAE Systems (BA.L) saw minor gains, contributing to the portfolio's overall growth.

On the downside, Evolution AB (EVVTY) declined further, dropping from -6.62% to -12.25%. Meta Platforms META 0.00%↑ also slipped, moving from 486.52% to 480.65%, while Alphabet GOOGL 0.00%↑ experienced a slight decrease from 80.81% to 77.61%.

The News

There haven’t been any significant news surrounding our holdings over the past two weeks.

Trades

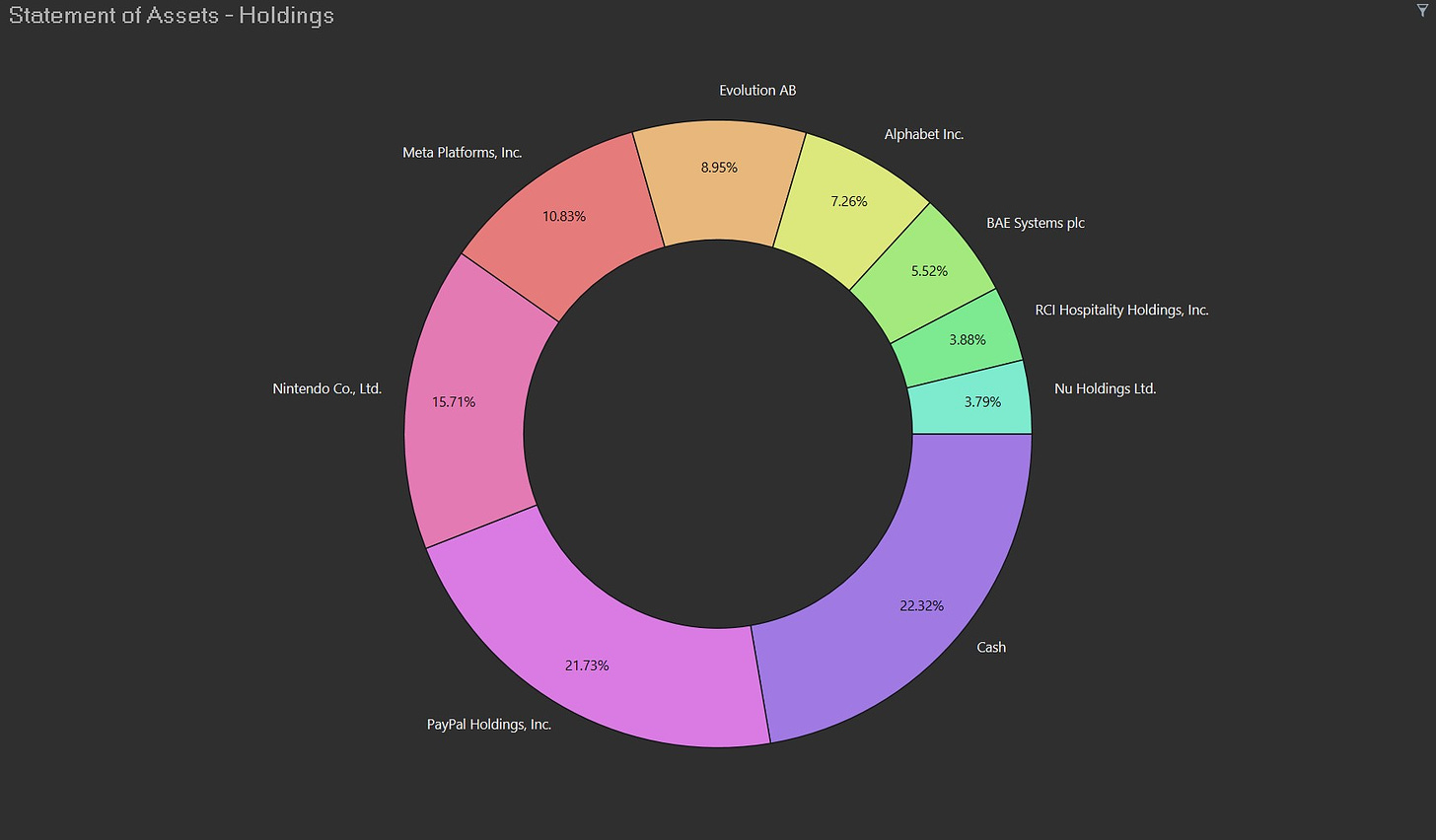

The only changes over the past two weeks have interest on cash. This brings the total cash allocation to 22.32%.

We’re currently finding it challenging to identify compelling new opportunities in the market. However, we’re considering increasing our position in Evolution AB, pending further clarity on the ongoing strike situation after the upcoming earnings call.

Statement of Assets

Cash

Share of Portfolio: 22.32%

Breakdown:

PayPal Holdings, Inc. (PYPL)

Share of Portfolio: 21.73%

Purchase Price: $63.05

Total Return: 25.88%

Investment Thesis:

Nintendo Co., Ltd. (NTDOY)

Share of Portfolio: 15.71%

Purchase Price: $12.41

Total Return: 7.33%

Investment Thesis:

Meta Platforms, Inc. (META)

Share of Portfolio: 10.83%

Purchase Price: $98.91

Total Return: 480.65%

Investment Thesis: Coming soon…

Evolution AB (EVVTY)

Share of Portfolio: 8.95%

Purchase Price: $102.31

Total Return: -12.25%

Investment Thesis:

Alphabet Inc. (GOOGL)

Share of Portfolio: 7.26%

Purchase Price: $91.32

Total Return: 77.61%

Investment Thesis: Coming soon…

BAE Systems plc (BA.L)

Share of Portfolio: 5.52%

Purchase Price: £12.70

Total Return: 5.76%

Investment Thesis: Coming this weekend!

RCI Hospitality Holdings, Inc. (RICK)

Share of Portfolio: 3.88%

Purchase Price: $47.42

Total Return: -6.74%

Investment Thesis: Coming soon…

Nu Holdings Ltd. (NU)

Share of Portfolio: 3.79%

Purchase Price: $7.38

Total Return: 90.65%

Investment Thesis:

We hope you found this valuable. Thank you once again for your continued support—we’re excited to bring you more updates soon!

The S.C. Team

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] PayPal (PYPL) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2ec95c38-51d6-4f98-a32f-f4bcfd42102c_2560x1920.jpeg)

![[FREE] Nintendo (NTDOY) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F85de3997-55a8-41ff-b579-f5aaa8bd1af6_400x400.jpeg)

![[FREE] Evolution AB (EVO.ST) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4563cd74-03c3-4c89-b5ee-f7047e980201_700x700.png)

![[FREE] Nu Holdings (NU) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbf450a78-515a-4766-a7b9-f43ca6a09672_2135x2120.png)

I would just invert your alocation %