Before we dive into the details of our newsletter changes and portfolio reveal, we want to take a moment to express our thanks for all the kind words and support on our recent posts. The growth in our subscribers has been amazing, and we really appreciate it!

The Change

After one of our recent posts, The Case for a Concentrated Portfolio, we took a step back to reflect on what we aim to create with this newsletter. This reflection led us to re-evaluate our initial posting schedule. One key reason we advocate for a concentrated portfolio is that it allows us to focus on our best ideas. However, our previous schedule—releasing equity research reports every Friday—seemed to contradict this principle. Posting every week began to feel like it might eventually lead to content created out of routine, rather than the carefully considered reports we believe are truly worth your time and attention.

To ensure we continue delivering valuable content, we’ve decided to make an important change. Moving forward, we will alternate between our stock reports and a new feature—portfolio updates—on a bi-weekly basis. This approach will ensure you receive the same amount of content, while allowing us to dedicate more time to thoroughly research and analyse the highest-quality stocks, and provide you with in-depth updates on our portfolio.

We’re excited about this shift and are confident it will lead to even better content for you. We’d love to hear your thoughts on this change—your feedback is always appreciated!

Portfolio Reveal

Now, let's talk about the most exciting part—our portfolio reveal! As part of our commitment to transparency and delivering high-quality insights, we are now opening up our portfolio for you to see.

What Does This Mean for You?

Full Portfolio Access: You’ll be able to see exactly what we’re holding and how we manage our investments. We’ve included all our current positions, performance data, and allocation breakdowns so you can get a clear picture of how our portfolio is structured.

Rationale and Analysis: For each stock, we’ll provide a detailed research report. Some of the reports are already available, and others are coming soon. Each report will include the rationale behind our investment decisions, the key factors we’re watching, and any recent changes we’ve made. This will allow you to understand why we hold each stock and what drives our conviction in these investments.

Ongoing Updates: With our bi-weekly schedule, you’ll receive regular updates on how our portfolio is performing and any adjustments we make along the way. Whether we’re adding new positions or adjusting current ones, you’ll be the first to know about changes and the reasoning behind them. We believe this ongoing communication will provide valuable insights into our decision-making process.

Performance

This update will serve as an introduction to our investment strategy and reveal the stocks in our portfolio. Going forward, future updates will include more detailed insights into our portfolio's performance, highlighting any adjustments we've made over the past two week period.

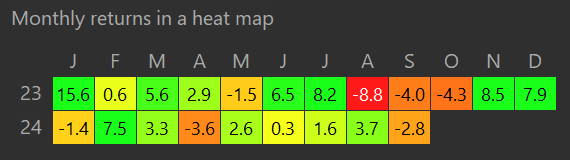

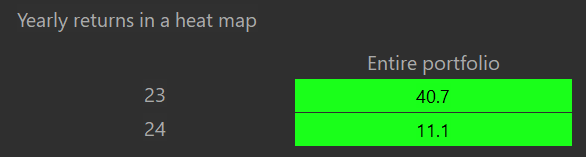

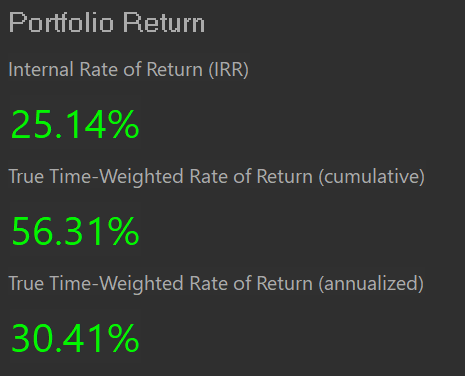

Our portfolio was initiated in January 2023, and we are happy to report that it has shown strong performance since inception. With a focus on high-quality stocks and a concentrated strategy, our investments have outpaced key benchmarks such as the S&P 500 (VOO), demonstrating the effectiveness of our approach.

Breakdown:

Cash

Share of Portfolio: 21.29%

PayPal Holdings, Inc. (PYPL)

Share of Portfolio: 20.30%

Purchase Price: $63.05

Total Return: +10.90%

Investment Thesis:

Nintendo Co., Ltd. (NTDOY)

Share of Portfolio: 16.78%

Purchase Price: $12.41

Total Return: +8.13%

Investment Thesis:

Evolution AB (EVVTY)

Share of Portfolio: 10.37%

Purchase Price: $102.31

Total Return: -4.08%

Investment Thesis:

Meta Platforms, Inc. (META)

Share of Portfolio: 10.23%

Purchase Price: $98.91

Total Return: +417.80%

Investment Thesis: Coming soon…

Alphabet Inc. (GOOGL)

Share of Portfolio: 7.32%

Purchase Price: $91.32

Total Return: +68.86%

Investment Thesis: Coming soon…

BAE Systems plc (BA.L)

Share of Portfolio: 5.87%

Purchase Price: £12.70

Total Return: +6.06%

Investment Thesis: Coming soon…

Nu Holdings Ltd. (NU)

Share of Portfolio: 3.95%

Purchase Price: $7.38

Total Return: +87.29%

Investment Thesis:

RCI Hospitality Holdings, Inc. (RICK)

Share of Portfolio: 3.88%

Purchase Price: $47.42

Total Return: -11.98%

Investment Thesis: Coming son…

Overall, we’re confident that by sharing our portfolio and the insights behind it, we can offer even more value to your investing journey.

Thank you again for your ongoing support—we can’t wait to share more with you soon!

The S.C. Team

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

![[FREE] PayPal (PYPL) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F2ec95c38-51d6-4f98-a32f-f4bcfd42102c_2560x1920.jpeg)

![[FREE] Nintendo (NTDOY) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F85de3997-55a8-41ff-b579-f5aaa8bd1af6_400x400.jpeg)

![[FREE] Evolution AB (EVO.ST) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F4563cd74-03c3-4c89-b5ee-f7047e980201_700x700.png)

![[FREE] Nu Holdings (NU) Equity Research Report](https://substackcdn.com/image/fetch/w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fbf450a78-515a-4766-a7b9-f43ca6a09672_2135x2120.png)