Firstly we are happy to announce that we've reached 2,500 subscribers! When we launched this page in August, our target was 1,000 subscribers by year-end—we've more than doubled that goal. Looking ahead, we've set an ambitious target of 15,000 subscribers by the end of 2025.

Performance

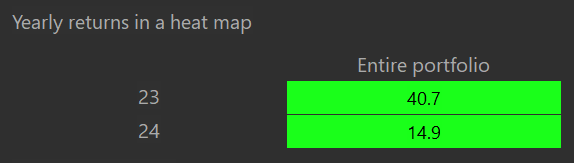

Our annualized Time-Weighted Return (TWR) since portfolio inception now stands at 27.13%.

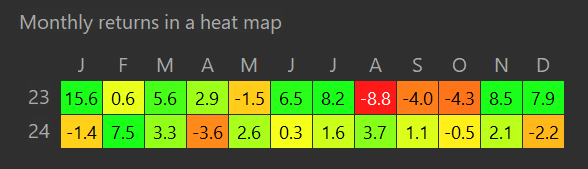

Our 2024 return was 14.9%. While this represents an underperformance compared to the broader market, we believe it's important to understand the context:

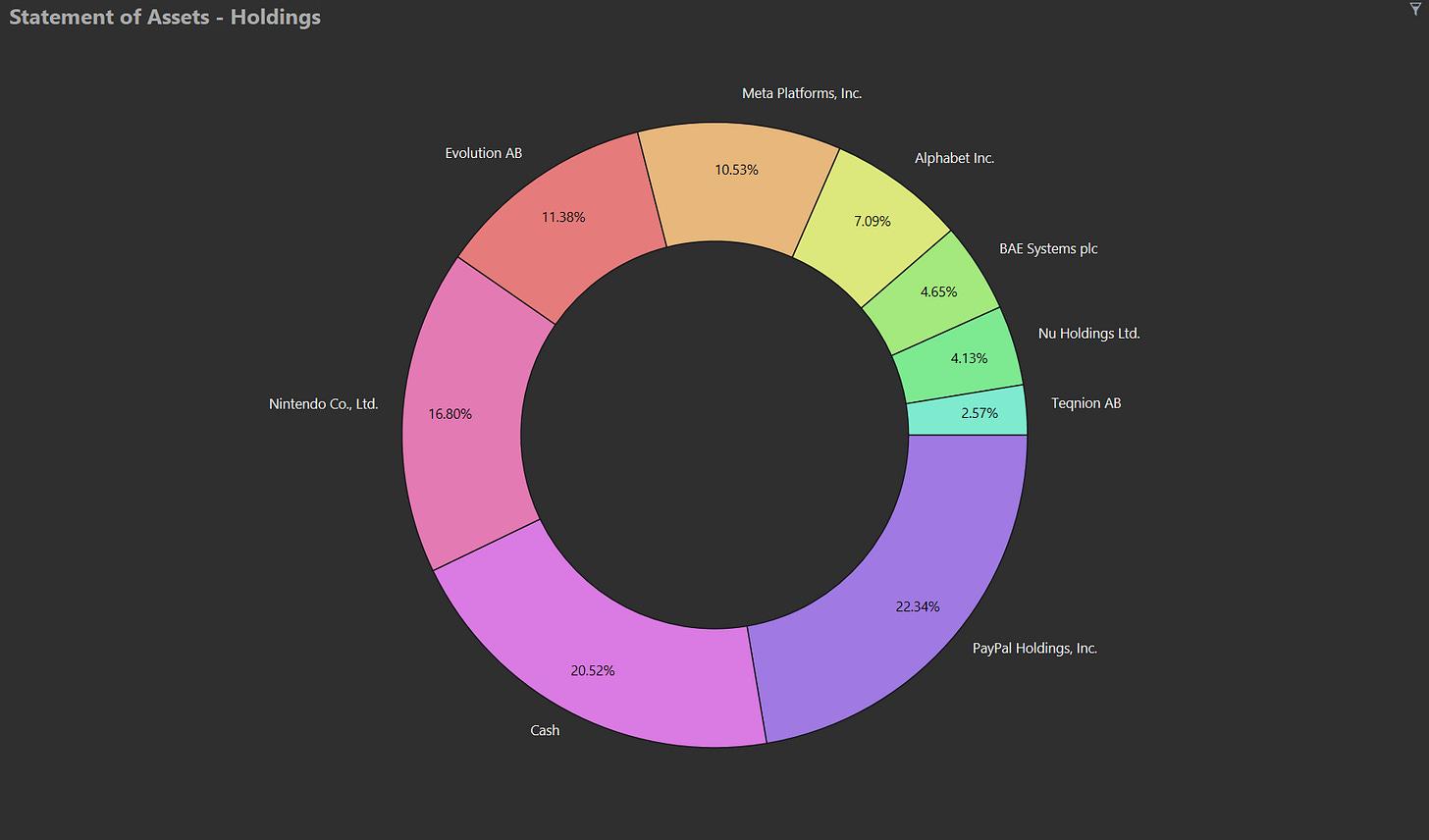

Cash Position Strategy: As per our investment philosophy, we only deploy capital when we identify high-conviction opportunities. This disciplined approach meant maintaining significant cash positions throughout the year, averaging around 20%. While this created a performance drag, we're comfortable with this outcome as patience and waiting for the right opportunities are fundamental to our strategy.

Market Concentration Reality: The S&P 500's performance this year has created what we believe is an unsustainable benchmark. Over 50% of the index's gains came from just eight stocks. For a more balanced comparison, the iShares S&P 500 Equal Weight UCITS ETF returned 12.3% this year, meaning our 14.9% actually represents outperformance against a more diversified benchmark.

In our view, we're currently witnessing nearly unprecedented levels of market concentration, with performance largely driven by a handful of AI-focused stocks. In our view, these conditions suggest some strong bubble-like market characteristics. Just look at the graph below.

Forward Statements

While we observe some fragility in the broader market, we maintain our disciplined, opportunity-driven approach rather than making broad market timing decisions. We have:

Strong confidence in our current portfolio positions, with multiple catalysts approaching.

Plans to publish updated Investment Thesis Statements for said positions in the coming months to educate both our old and new subscribers.

Expected increased cash inflows in 2025, likely leading to a lower average cash position.

Potential addition of one new position when the right opportunity presents itself.

We have also launched two new pages ready for 2025!

Compounding Quotes: Compounding Quotes has one mission: to make you a little wiser every day. As a subscriber, you can expect 3 quotes every single day from investors, business leaders, and thought leaders as well as some bonus recommended reads. As simple as that.

Long Volatility: Is an exciting project that we will launch in the next few months, highlighting Schwar Capital’s barbell portfolio, closely inspired by Nassim Talebs insights.

We are exited for our first full year on Substack, we hope you are too.

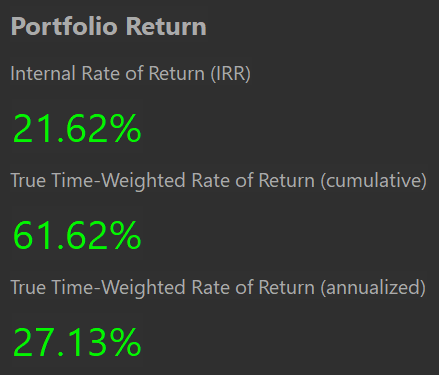

2024 Visual Performance and Statement of Assets

We hope you found this valuable. Have great New Year!

The S.C. Team

Disclaimer: The content provided in this newsletter is for informational purposes only and does not constitute financial, investment, or other professional advice. The opinions expressed here are those of the author and do not necessarily reflect the views of Schwar Capital. Investing involves risk, including the possible loss of principal. Past performance is not indicative of future results. The author may or may not hold positions in the stocks or other financial instruments mentioned. Always do your own research or consult with a qualified financial advisor before making any investment decisions.

2.5k! Congrats! What's your goal for 2025?

Congrats on hitting 2,500 subscribers! Well deserved! See you at 5,000 :)